|

|

|

Mulvane Cooperative

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

No Bull | The Five Spot

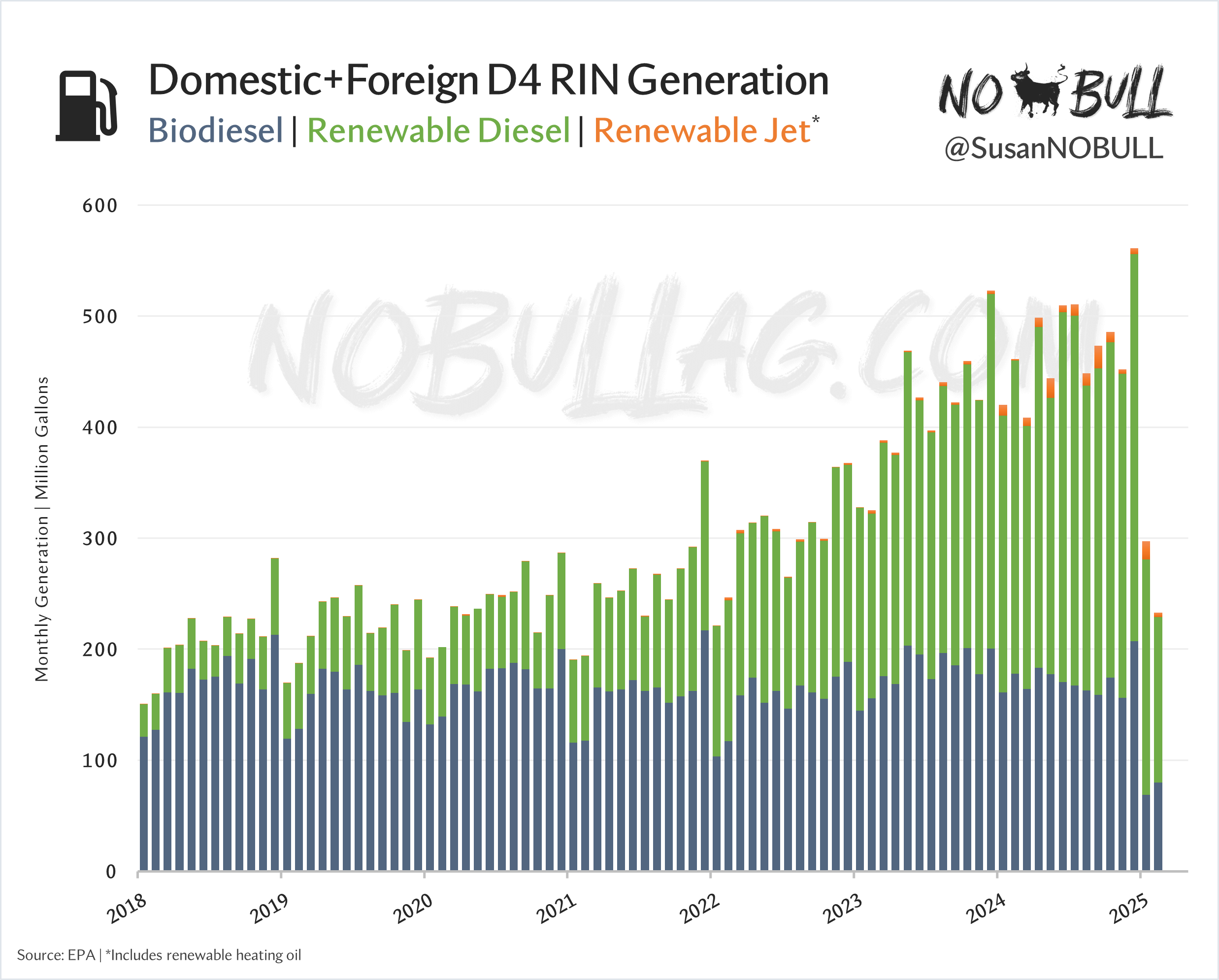

1 | King CornOnly a few days remain until March 31’s Prospective Plantings report which will set the tone for new crop trade the next several months. New crop acreage intentions are highly correlated with February averages not only because price action can drive planting decisions, but crop insurance guarantees are an important part of risk management on the farm. Heading into Monday’s report, analysts are expecting 94.4 million acres of corn and 83.8 million acres of beans for a combined acreage pool just over 178 million. Interesting to compare corn’s 53% of the C+B acreage pool (based on estimates) vs the Feb average ratio at 2.24:   2 | 2.3The race for new crop acres is underway and while corn still holds the lead, soybeans have narrowed the gap this week amid pre-report position squaring and recent [positive] biofuel headlines:   3 | Big MovesSoybean oil has seen its largest gains since January (the day 45Z guidance was released) after reports big oil and agriculture are teaming up to seek higher biomass-based diesel blending requirements in Renewable Fuel Standard volume mandates for 2026 and beyond. Why is bean oil so sensitive to biofuel policy headlines? Headline ups and downs: << Since 2020, there have been 8 days bean oil rallied >5% - that same news outlet printed a POSITIVE biofuel policy headline 6 of those days. The other 2 were days immediately following Russia's invasion of Ukraine   4 | D4 Disaster2025 biofuel data is beginning to trickle in… and it is confirming our fears: a massive drop in biomass-based diesel production with the expiration of 40A's long-standing $1.00 per gallon biomass-based diesel blending credit at the end of 2024. The U.S. generated just over 230 million gallon-equivalents in D4 RINs in February, down 50% year-on-year and a three-year low. The catastrophic decline comes as 45Z's policy offers a fraction of 40A's $1.00 subsidy, the loss of credits on imported biofuels, and lingering uncertainties amid a lack of a final rule and a new EPA with forward mandates still in question.   5 | Breaking down a bushelCrazy to look at the additional value soybean oil has contributed to soybean futures since the renewable diesel boom began in 2021. Today, bean oil contributes an extra $1.25 per bushel to bean futures above its long term average value, illustrating why biofuels and their policies are vitally important to the soybean market.  For the full version of this post or to subscribe, visit NoBullAg.Substack.com. Thanks!  This article contains syndicated content. We have not reviewed, approved, or endorsed the content, and may receive compensation for placement of the content on this site. For more information please view the Barchart Disclosure Policy here.

|

|

|