|

|

|

Mulvane Cooperative

News

Ag Commentary

Weather

Resources

|

This Tech Stock Aims to Return 80% of FCF in Dividends and Buybacks. Should You Buy It Now?

Global data center capacity is expected to grow by three and a half times between 2025 and 2030, driven entirely by the rise of AI workloads. AI-related capacity could increase by 124 gigawatts over the next five years, with AI workloads alone requiring 156 gigawatts by 2030, more than four times the 2025 level. Major technology companies are projected to spend between $350 billion and $400 billion this year on capital expenditures, most of it going into building AI data centers. Dell Technologies (DELL) has placed itself right in the middle of this trend, reporting record second-quarter fiscal 2026 revenue of $29.8 billion. In just the first half of fiscal 2026, the company shipped $10 billion worth of AI solutions, already surpassing what it shipped in the entire previous fiscal year. Dell also raised its long-term revenue growth targets to between 7% and 9% annually while increasing its AI server shipment guidance for fiscal 2026 to $20 billion. For investors focused on income, Dell continues to stand out by committing to return at least 80% of its adjusted free cash flow to shareholders through dividends and buybacks. With the stock already posting one-month returns of 22.61%, is Dell's combination of AI-driven growth and substantial shareholder returns too attractive to ignore? Let’s take a closer look. Breaking Down Dell’s Latest Financial ShowingDell is a global player in computing infrastructure and services and earns revenue from a broad mix of business lines, including client solutions, enterprise servers and networking, storage, and cloud-based innovations. Over the past 52 weeks, DELL's price has risen 20.03%, with a year-to-date (YTD) gain of 33.04%, showing solid investor confidence in its ability to capitalize on growing demand for AI and enterprise IT solutions.

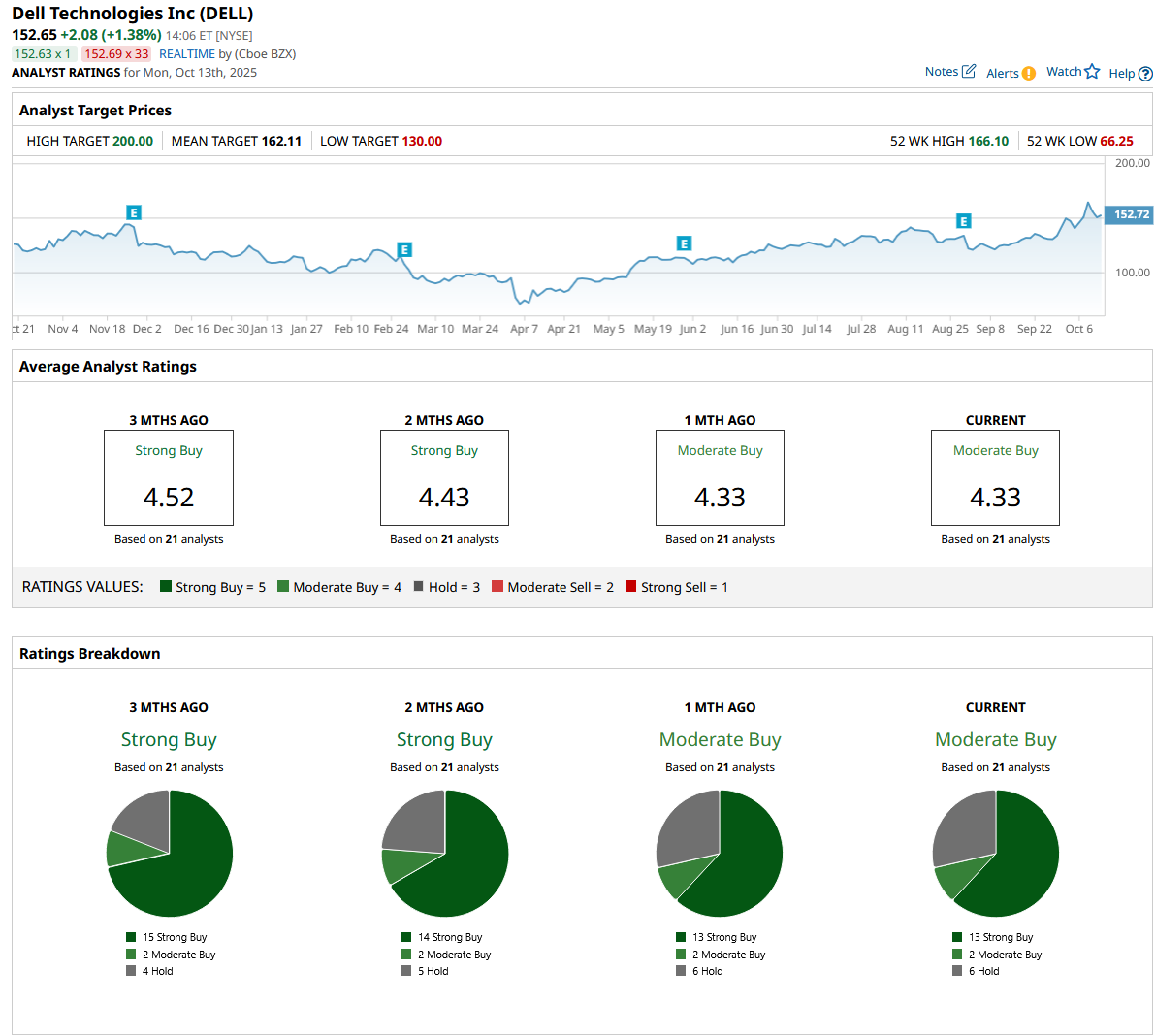

On valuation, Dell’s forward price-to-earnings (P/E) ratio stands at 18.01x, noticeably below the sector average of 25.77x, pointing to potential value despite strong performance. For income investors, Dell offers an annual dividend yield of 1.94%, equal to $0.525 per share, last paid on July 22. The forward payout ratio is 24.28%, with quarterly dividends that have grown for three straight years, supported by consistent free cash flow. In fiscal Q2 2026, Dell reported record revenue of $29.8 billion, up 19% year-over-year (YoY); operating income of $1.8 billion, up 27%; and record non-GAAP EPS of $2.32, up 19%. Cash flow from operations reached $2.5 billion. The Infrastructure Solutions Group delivered $16.8 billion in revenue, up 44%, driven by a 69% increase in servers and networking to $12.9 billion, while storage fell 3% to $3.9 billion. The Client Solutions Group brought in $12.5 billion in revenue, up 1%, with commercial sales slightly higher but consumer sales down 7%. Dell returned $1.3 billion to shareholders in the quarter through dividends and buybacks, underscoring its commitment to rewarding investors. The Growth Drivers Powering Dell’s Next ChapterDell’s new PowerEdge XR8720t server marks a big step in performance and efficiency for telecom and enterprise edge systems. It was built specifically for Open RAN and Cloud RAN setups and removes the need for expensive multi-server setups by introducing the first single-server Cloud RAN solution in the industry. This helps reduce space, power use, and operational challenges while delivering the fast response times needed for modern network applications, giving businesses a way to upgrade infrastructure without higher costs. Meanwhile, Dell’s collaboration with Cloudera is taking its AI capabilities further into the enterprise space. By combining Dell ObjectScale with Cloudera’s Private AI platform, the two have created a tested, scalable, and easy-to-manage “AI-in-a-Box” setup. It allows companies, especially in regulated sectors, to run AI workloads securely on-site. Dell is also reinforcing its private cloud position with data center improvements tailored for both older and newer workloads. Through its Automation Platform and flexible infrastructure systems like PowerStore, PowerFlex, and PowerMax, Dell is helping organizations automate, scale, and secure their private clouds with AI-powered control. What Analysts Predict for DellDell expects fiscal 2026 revenue between $105.0 billion and $109.0 billion, with the midpoint of $107.0 billion representing 12% growth from last year. Earnings are also projected to rise, with GAAP diluted EPS estimated at $7.98, up 25%, and non-GAAP EPS at $9.55, up 17%. Recent analyst calls reflect confidence in these numbers. On Sept. 30, Wells Fargo’s Aaron Rakers reaffirmed his “Buy” rating with a $160 price target, pointing to Dell’s strong execution in infrastructure, consistent demand in AI-driven areas, and shareholder-focused capital returns. UBS’s David Vogt also kept a “Buy” rating with a $155 target, noting improvements in enterprise solutions and Dell’s ability to grow high-margin sectors even with weaker consumer sales. The 21 analysts covering DELL rate it a consensus “Moderate Buy,” with a mean price target of $162.11. DELL stock is trading slightly below that at $152.65. It is still hovering around most near-term predictions but still showing potential upside of about 5% toward Wells Fargo’s target. ConclusionPutting everything together, Dell stands out as a mix of steady growth and consistent shareholder returns. It continues to benefit from rising demand for AI infrastructure while returning a large share of profits through dividends and buybacks. Revenue, earnings, and free cash flow are all trending higher, and management’s plan to return 80% of that free cash flow to shareholders adds more appeal. With solid fundamentals and stronger guidance in place, Dell’s momentum still looks intact. Even though the stock trades a bit above the average analyst target, its direction over the next few quarters appears tilted upward as AI spending and payouts keep improving.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|