|

|

|

Mulvane Cooperative

News

Ag Commentary

Weather

Resources

|

Here's What to Expect From Camden Property Trust's Next Earnings Report

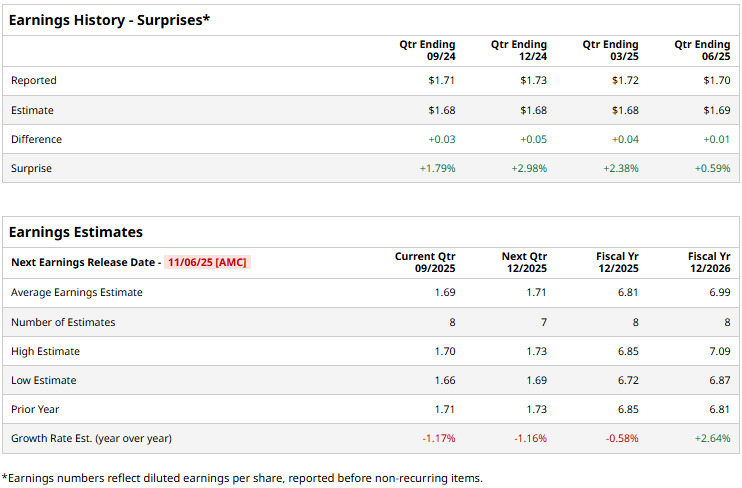

Houston, Texas-based Camden Property Trust (CPT) engages in the ownership, management, development, repositioning, redevelopment, acquisition, and construction of multifamily apartment communities. With a market cap of $10.9 billion, Camden operates as one of the major owners of apartments in the United States. The real estate major is set to announce its third-quarter earnings after the market closes on Thursday, Nov. 6. Ahead of the event, analysts expect CPT to deliver core funds from operations (CFFO) of $1.69 per share, down 1.2% from $1.71 per share reported in the year-ago quarter. On a positive note, the company has surpassed the Street’s CFFO estimates in each of the past four quarters. For the full fiscal 2025, CPT’s CFFO per share is expected to come in at $6.81, marginally down from $6.85 reported in 2024. While in fiscal 2026, its CFFO is expected to grow 2.6% year-over-year to $6.99 per share.

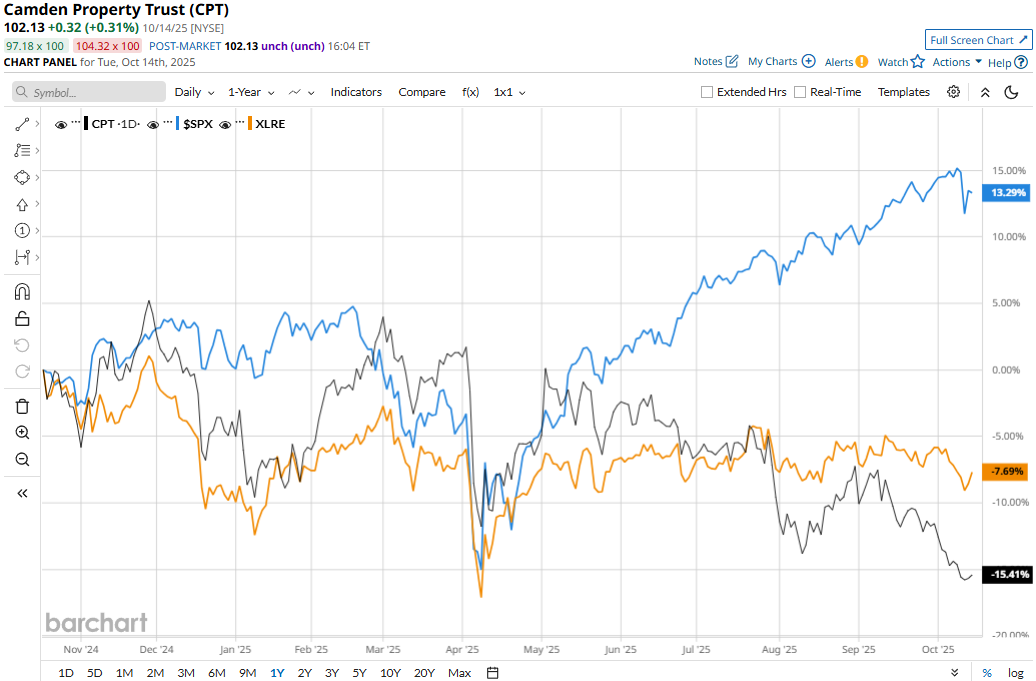

CPT stock prices have plummeted 14.6% over the past 52 weeks, notably underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 5.6% decline and the S&P 500 Index’s ($SPX) 13.4% gains during the same time frame.

Despite delivering better-than-expected results, Camden’s stock prices dipped 2.1% in the trading session following the release of its Q2 results on Jul. 31. The company’s property revenues for the quarter increased 2.4% year-over-year to $396.5 million, beating the consensus estimates by a thin margin. Meanwhile, the company’s cash flows remained under pressure, its core funds from operations (CFFO) decreased by a marginal 18 bps year-over-year to $187.6 million. However, its CFFO per share of $1.70 surpassed the Street’s estimates by 59 bps. The drop in CPT stock prices can be attributed to the broader market downturn observed during the trading session, due to the chaos created by President Trump’s tariff announcements. Analysts remain cautiously optimistic about CPT’s prospects. The stock maintains a consensus “Moderate Buy” rating overall. Of the 27 analysts covering the stock, opinions include nine “Strong Buys,” one “Moderate Buy,” 14 “Holds,” and three “Strong Sells.” Its mean price target of $121.51 suggests a 19% upside potential from current price levels. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|